By Franklin Chu, Azoya USA

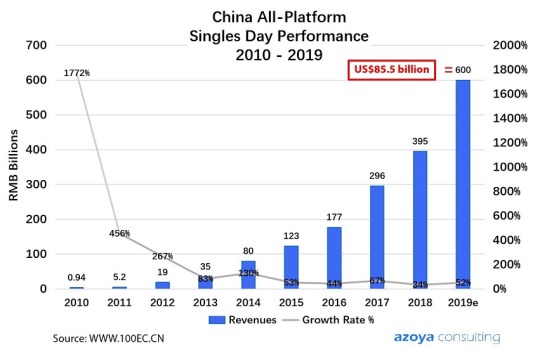

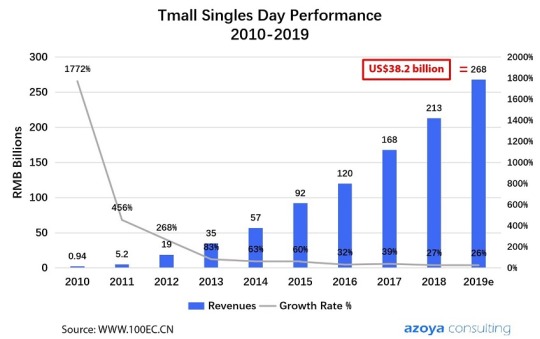

Today’s e-Commerce market is oversaturated and many players are losing steam and losing money. Yet Chinese e-Commerce giant Alibaba recorded a whopping $38.4 billion in GMV this year, a 26% jump from last year’s Singles Day.

While growth is slowing, it remains strong and impressive for a company as large as Alibaba. In this brief wrap-up we dive deeper into how cross-border e-Commerce performed this year.

Alibaba Growth Powered By Lower-Tier Cities, Livestreaming And New Brands

Alibaba’s strengths include incredible foresight and long-term vision. Early on, management knew the market would get more competitive, so they laid the groundwork for new strategies long before they were needed.

Their plan included focusing on lower-tier cities, integrating online-offline retail and building an ecosystem of livestreaming influencers on Taobao.

Lower-tier cities: 102 million new users participated in Singles Day this year, mostly from lower-tier cities. Alibaba claims more than 70% of new users in fiscal 2019 came from lower-tier cities.

New product launches: Over 1 million new products launched for Singles Day. Launching limited-edition products like MAC lipstick help Alibaba to stand out from competitors with exclusive products.

Livestreaming: Chinese e-Commerce web site Taobao raked in $1.4 billion worth of sales within the first eight hours and 55 minutes of Singles Day. Over 100,000 brands used livestreaming to promote their products during the day, including U.S. and foreign brands MAC, Levi’s, Ralph Lauren, Sisley and Burberry.

While Taobao’s livestreaming feature has been around for years, in 2019 it became a major focus due to intense competition as brands seek to capture customers’ attention.

Livestreaming effectively activates potential customers who have browsed your products for a long time without making a purchase. It is most useful for marketing visual products like apparel and cosmetics.

Who Were The Top Sellers?

This year, 299 brands each brought in more than $15 million in revenues on Singles Day, up from 237 in 2018.

Top brands included Estée Lauder, Apple, Li Ning (sportswear), Bosideng (apparel), Perfect Diary (cosmetics) and HomeFacialPro (skincare).

Brands earning over $15.1 billion in GMV across multiple platforms (not just Tmall) include: Uniqlo, Semir (apparel), Gree (air conditioners), Anta (sportswear), Linshimuye (furniture), Estee Lauder, Xiaomi (smartphones), Haier (white goods appliances) and Midea (white goods appliances).

These results mean:

1. More sales are concentrated among a few big brands. The amount of capital required to compete effectively during such holidays has increased.

2. Chinese brands are becoming more popular, as foreign brands previously dominated this list.

How Cross-Border E-Commerce Fared On Singles Day 2019

In total, 22,000 cross-border e-Commerce brands from 78 countries participated in Tmall Global’s Singles Day promotions, selling more than 620,000 imported products, most of which are unavailable in China for various reasons.

Over 120,000 new products were launched just for Singles Day, indicating the retail extravaganza effectively builds brand awareness.

To further entice customers, 2,500 of these brands covered the costs of import duties and shipping; Alibaba also provided interest-free installment loans for 24 months.

The hottest categories according to Tmall were beauty tech gadgets, imported cultural products, sleeping pills/aids, pet food, products for the elderly and male skincare products.

Japanese beauty tech brand Ya-Man sold 6,000 products within just 30 seconds. Notably, each of these products costs more than $1,500.

Which trends did Azoya see this year? Top trending categories included beauty, skincare and health products.

Specifically, we saw increased demand for facial masks, tooth whitening products, perfume, eye shadow, skin moisturizer, anti-wrinkle cream, laxatives and ginkgo leaf extract. Many of these products include ingredients that cannot be found or manufactured in China, or cannot be imported due to animal testing laws cosmetics brands have to abide by.

Key Takeaways

1. Despite its size, Alibaba maintained strong growth this year by focusing on lower-tier cities, helping brands launch new products and using livestreaming influencers to activate sales.

2. More brands surpassed the $15 billion GMV mark, indicating more sales are concentrated within the larger brands; however Chinese brands are gaining in popularity.

3. Cross-border e-Commerce continued to perform well. Popular subcategories included beauty tech gadgets, pet food, sleeping aids, tooth whitening products and other products with ingredients that are difficult to find in China.

Franklin Chu is Managing Director U.S. for Azoya USA, a provider of turnkey cross-border e-Commerce solutions to assist retailers looking to expand into China through a cost-effective and lower risk method. To date, more than 35 retailers in 11 countries are partnering with Azoya to expand into China with ease, including French fashion retailer, La Redoute, Australia’s largest pharmacy group, Sigma, Europe’s largest online beauty retailer, Feelunique, and United States premier retailer of juvenile products, Babyhaven.